It goes without saying: property cost a lot, should it be the fresh new otherwise a century family. It’s also correct that recently renovated residential property bring in a paid price.

And you will Canadians are prepared to renovate. A recent declaration discovered 49% of Canadians possess both currently done household home improvements before year, otherwise these include planning to redesign soon.

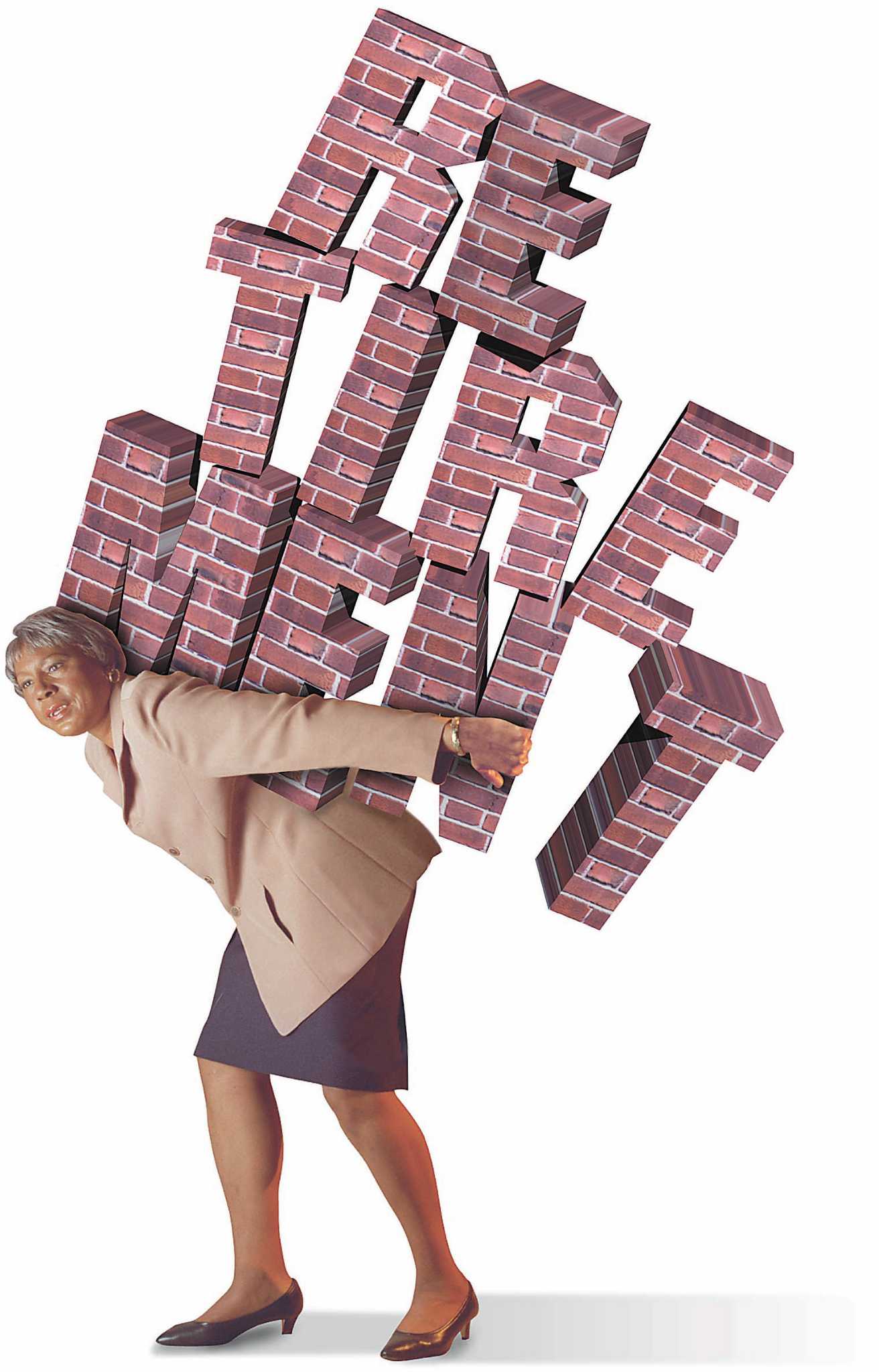

Although people seek out buy fixer-uppers, the fresh new highest price of restoration gadgets, offers, and you may labour means they have to add the cost of renovations on the financial. And sometimes property owners you would like a hand to greatly help buy renos to store property habitable otherwise succeed warmer.

Can add recovery will cost you so you’re able to a mortgage inside the Canada and have solutions to several of the most prominent repair financial funding concerns.

What exactly is a restoration financial?

The definition of restoration home loan identifies that loan protected against a property with the objective of reount, rates, length, and other terms of the loan believe the kind of renovation real estate loan you earn.

While wanting to know ought i rating a mortgage having additional money for home improvements whenever to order a home?’ or should i play with home financing getting renovations in our current family?’ brand new quick response is possibly.

Generally – each problem is a bit various other. Your home Kinston loans guarantee, market value of the house, your own financial predicament, many of these affairs come into play having home loan renovation resource.

The first thing pertains to determining what you want otherwise need certainly to manage. 2nd, you’ll need to score a quotation about how precisely much they will cost you. This can help you narrow down your renovation mortgage capital choice and see just how a restoration home loan could work on your own condition.

Advantages of a property reno home loan

Home financing is not the only way to invest in family solutions or renovations. Other option funding choices for domestic home improvements include:

- With your deals so you’re able to update your house in the place of entering debt Using a charge card

- An unsecured personal line of credit

- A secured line of credit (household security line of credit otherwise HELOC)

- An unsecured loan

- Financing of a member of family

Any of these house repair funds choices are enticing as they are much easier and you may quick to arrange and availableness. Yet not, if you are planning an even more thorough repair investment, a home repair mortgage loan can offer the next benefits:

- Lower rates of interest

- Straight down monthly premiums since financing will get amortized more than a longer period

- Use of a top amount depending on your residence security

- A good idea to have borrowers which you’ll feel inclined to punishment the flexibleness out of other family repair choices listed above – such as credit lines otherwise handmade cards

Possibly loan providers refinance a home to get into collateral necessary to complete small renovations. Thus, in case the most recent home loan equilibrium try lower than 80% of the most recent ily income supporting a much bigger home loan matter, it is possible to meet the requirements to help you re-finance their financial with more fund.

While you are to invest in a property that requires really works, thought a buy together with improve home loan. This allows you to finish the work needed on domestic with your loans. Up coming because the home improvements was complete, the lending company launches funds to you along with your home loan matter increases.

Such as for example, you may purchase a house having a mortgage of $600,one hundred thousand, and you can an improve level of $twenty five,100. You utilize savings to do the brand new improvements/reount grows so you’re able to $625,100000 therefore found $twenty-five,100000 bucks so you can renew your deals.

Ways to use your home loan to own home improvements

Which have restoration mortgage loans, part of the loans wade on purchase price or latest financial harmony, and the other countries in the money are usually placed into the family savings or possibly advanced to a homes/renovation team, based your information and you can financial plan.

One to trick matter to remember that have mortgage renovation fund is that interest begins accruing throughout the big date brand new restoration finance get transferred to the savings account, if or not make use of them to security your renovation will cost you or otherwise not.

It is vital to believe all your valuable options available with regards to so you’re able to home restoration funding for the the latest otherwise existing fixer-upper family. Think of, your financial situation is special for you. To help make the proper choice when it comes to your house restoration financing, talk to a home loan specialist today.

What’s an excellent readvanceable mortgage?

To find a house or refinancing your own mortgage? Here’s what you have to know regarding readvanceable mortgage loans, one of the smaller-common however, oh-thus strong home loan solutions.

Provided a house reno? Ask these types of nine questions when employing a contractor

If or not we should help make your fantasy family or improve your house’s worthy of obtainable, you really need to discover a company you can trust. Some tips about what to ask whenever choosing a contractor.

What is domestic equity and exactly how do I use it?

Understand how to use the latest guarantee of your home, simple tips to assess it, plus the benefits and drawbacks of employing it in order to reach finally your monetary requires eventually.