Can i put repair will set you back to my financial?

It goes without saying: property cost a lot, should it be the fresh new otherwise a century family. It’s also correct that recently renovated residential property bring in a paid price.

And you will Canadians are prepared to renovate. A recent declaration discovered 49% of Canadians possess both currently done household home improvements before year, otherwise these include planning to redesign soon.

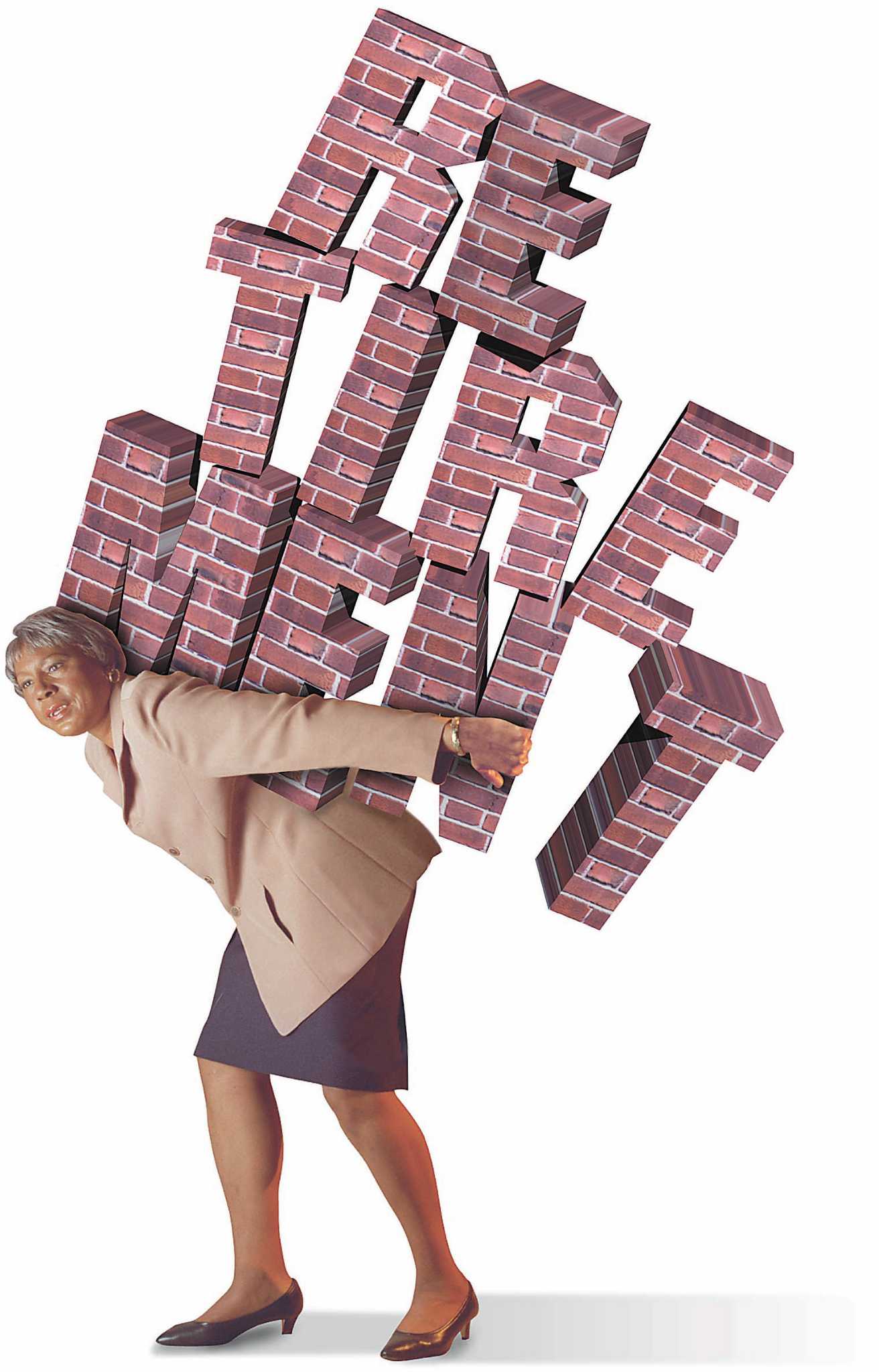

Although people seek out buy fixer-uppers, the fresh new highest price of restoration gadgets, offers, and you may labour means they have to add the cost of renovations on the financial. And sometimes property owners you would like a hand to greatly help buy renos to store property habitable otherwise succeed warmer.

Can add recovery will cost you so you’re able to a mortgage inside the Canada and have solutions to several of the most prominent repair financial funding concerns.

What exactly is a restoration financial?

The definition of restoration home loan identifies that loan protected against a property with the objective of reount, rates, length, and other terms of the loan believe the kind of renovation real estate loan you earn.

While wanting to know ought i rating a mortgage having additional money for home improvements whenever to order a home?’ or should i play with home financing getting renovations in our current family?’ brand new quick response is possibly.